Equity Builder Loan

Purchase Example

Primary Residence

Sales Price: $800,000

Loan Amount: $640,000 (80%)

Down Payment: $160,000 (20%)

Average Deposits:

$7,500 twice a month (semi-monthly)

$10,000 bonus twice a year (semi-annually)

One-Time Deposit: $25,000 (no longer need savings)

Expenses:

Escrows: $800 (taxes & insurance)

Monthly Living Expenses: $10,131

Net Monthly Savings: $2000 (12%)

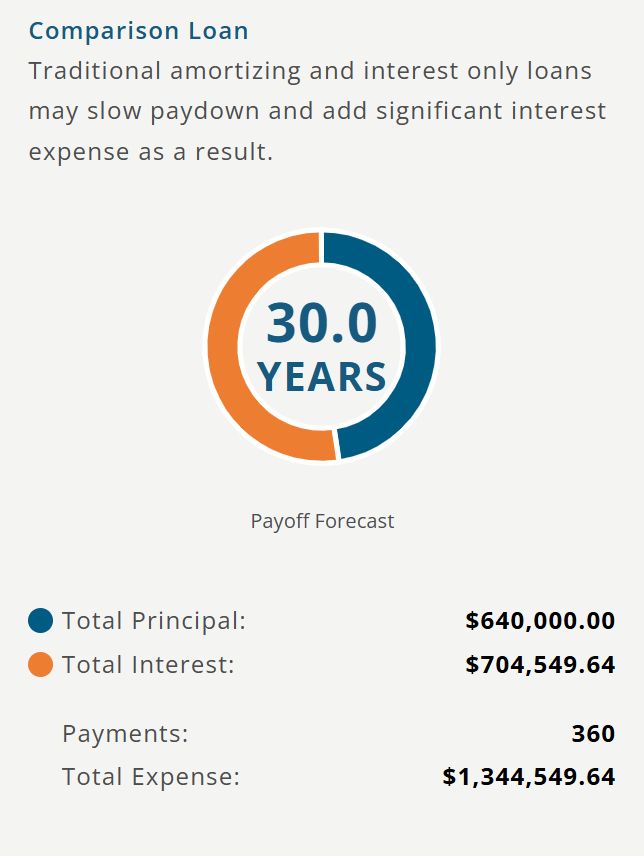

Comparison

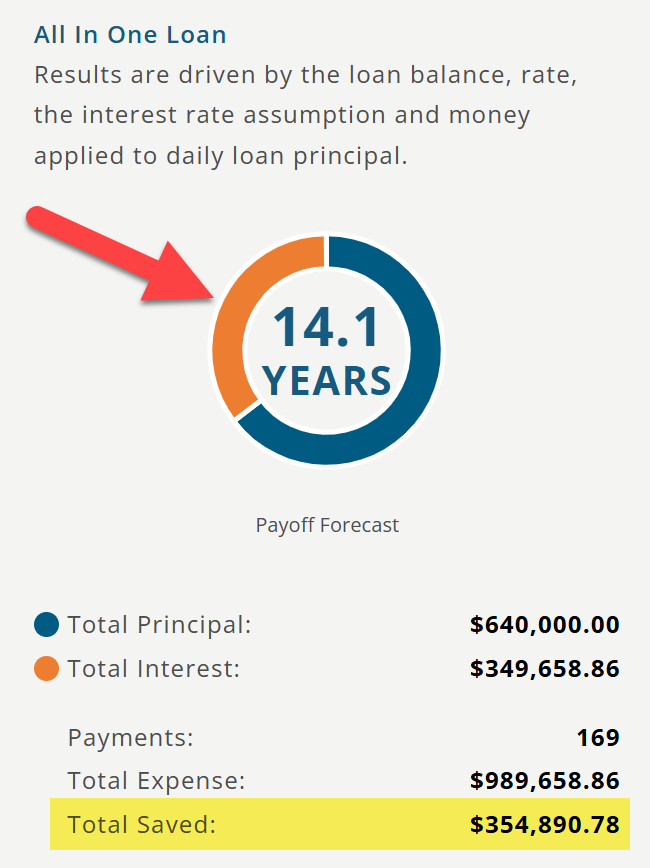

Equity Builder Loan:

AIO Loan Margain: 3.25%

AIO Loan Index: 3.679%

AIO Loan Rate: 6.929%

Comparison Loan:

30-year Fixed: 5.75%

Principal & Interest: $3734

Results

NOTES

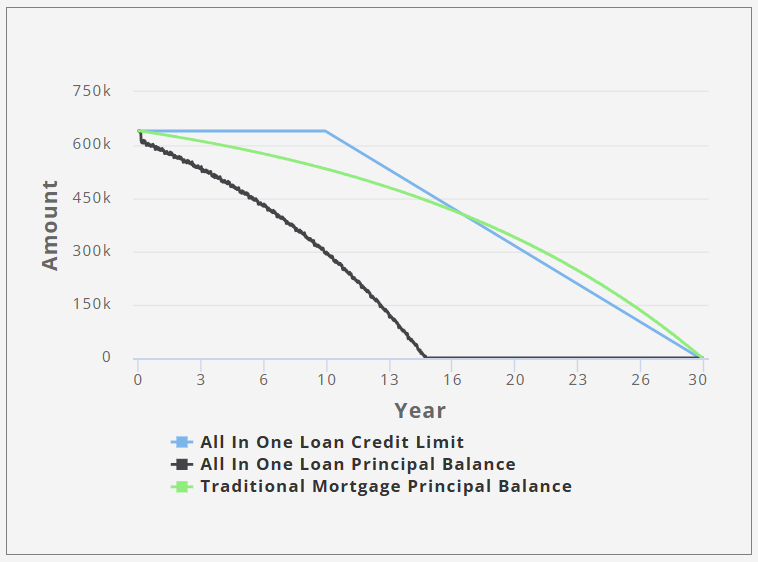

AIO Loan Pays Off in 14.1 Years

30 Year Pays Off in 30 Years

AIO Loan Total Expense: $989,658

30 Year Total Expense: $1,344,549

AIO Loan Saves $354,890 in Interest

Effective APR: 3.146%

WEALTH ACCUMULATION

$1,544,225 would be YOUR balance in your investment account if your loan was paid off and your Financial Advisor invested the $3734 per month and earned 7% a year for the remaining 15.9 years. This is your money working for you!

One note regarding this example. This example was using a Rate Trend of “Remain a Current Rate”. If we selected the Rate Trend to use a Historical Average Rate, the savings would have been $475,031, with an Effective APR of 2.155%. We like to use a more conservative approach in our examples.