Equity Builder Loan

Refinance Example

Primary Residence

Appraised Value: $800,000

Loan Amount: $640,000 (80% LTV)

Average Deposits:

$7,500 twice a month (semi-monthly)

$10,000 bonus twice a year (semi-annually)

One-Time Deposit: $25,000 (no longer need savings)

Expenses:

Escrows: $800 (taxes & insurance)

Monthly Living Expenses: $10,379

Net Monthly Savings: $2000 (12%)

Comparison

Equity Builder Loan:

AIO Loan Margain: 3.25%

AIO Loan Index: 3.679%

AIO Loan Rate: 6.929%

Existing Loan:

30-year Fixed: 5.00%

Had Loan For: 12 months

Principal & Interest: $3487

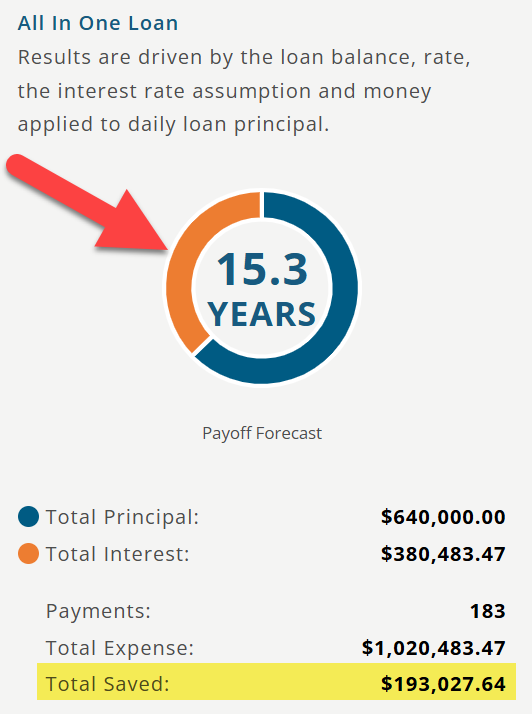

Results

NOTES

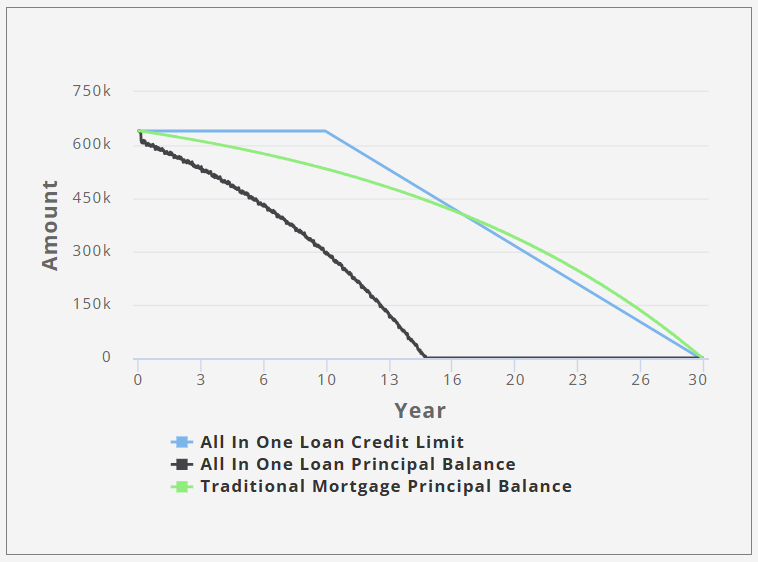

AIO Loan Pays Off in 15.3 Years

30 Year Pays Off in 29 Years

AIO Loan Total Expense: $1,020,483

30 Year Total Expense: $1,213,511

AIO Loan Saves $193,027 in Interest

Effective APR: 3.390%

WEALTH ACCUMULATION

$962,993 would be YOUR balance in your investment account if your loan was paid off and your Financial Advisor invested the $3487 per month and earned 7% a year for the remaining 14,7 years. This is your money working for you!

One note regarding this example. This example was using a Rate Trend of “Remain a Current Rate”. If we selected the Rate Trend to use a Historical Average Rate, the loan would be paid off in 13.1 years and the savings would be $329,107, with an Effective APR of 2.282%. We like to use a more conservative approach in our examples.